Pension Advice

Pension Advice

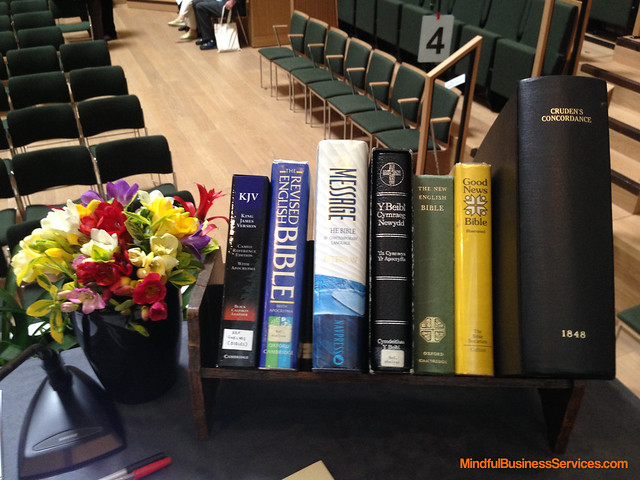

There was a time when the only reference books found in a meeting house were similar to those seen at the Clerks’ table at Yearly Meeting. Over the years, as many Area Meetings have registered as charities, this has changed and now legal advice is as necessary as spiritual. While pensions are mentioned in the bible, it doesn’t qualify as helpful advice.

At the Managing Meeting Houses course last month there were several anxious questions about pensions.

- Do they apply to all employees?

- Do we have to set one up for our volunteer wardens?

- What about ‘flexible’ employees with limited contracts – often known as zero-hour contracts?

Obviously, I’d recommend seeking professional advice if you have any concerns. The guidance given here is a summary of what I’ve found useful, and supplied to my clients on request.

- Yes – every employer with at least one eligible member of staff must enrol them onto a workplace pension scheme, and then contribute towards it.

- Volunteer wardens aren’t employees and so don’t qualify for auto enrolment. You aren’t able (as a meeting) to contribute into a pension for them as this is seen as payment in kind. That creates problems for their employment status. From the very helpful gov.uk website: Workers employed and paid by the charity for the work they do are eligible for pensions if they:

- earn more than the current minimum wage

- are aged between 22 and the state pension age

- work in the UK

‘Workers’ include contractors and agency staff, as well as people working under an apprenticeship. Volunteers and unpaid staff are not eligible.

- Contractors who are on zero hour contracts and work in other places may not qualify for pensions. You may need to take legal advice regarding the contracts you use and your employment and recruitment policies.

The Charity Finance Group (CFG) has produced a useful guide to pensions – downloadable from that link. The publication hopes to provide some guidance for the 22,000+ charities, each with less than 25 members of staff, who are due to be auto-enrolling their staff between 1st January 2016 and 1st April 2017.

The guide is easy to read with advice on how to prepare, implement, and build the necessary processes. It urges you to plan early and budget for additional costs created by auto-enrolment.